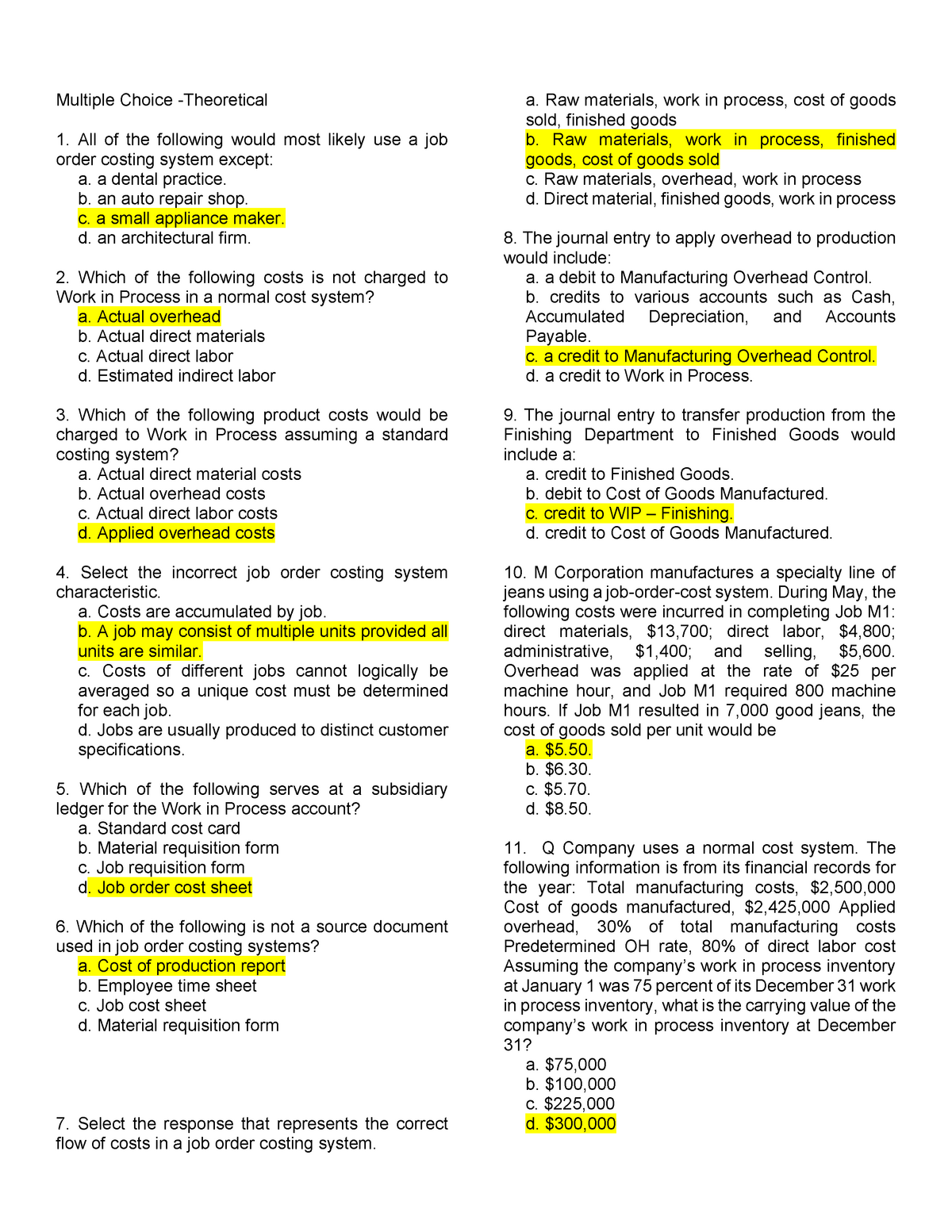

A Normal Costing System Applies Overhead

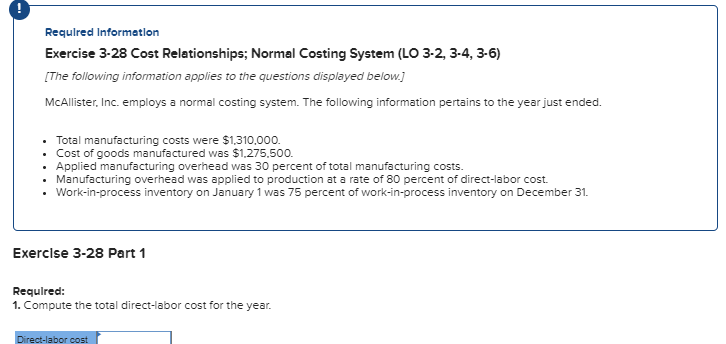

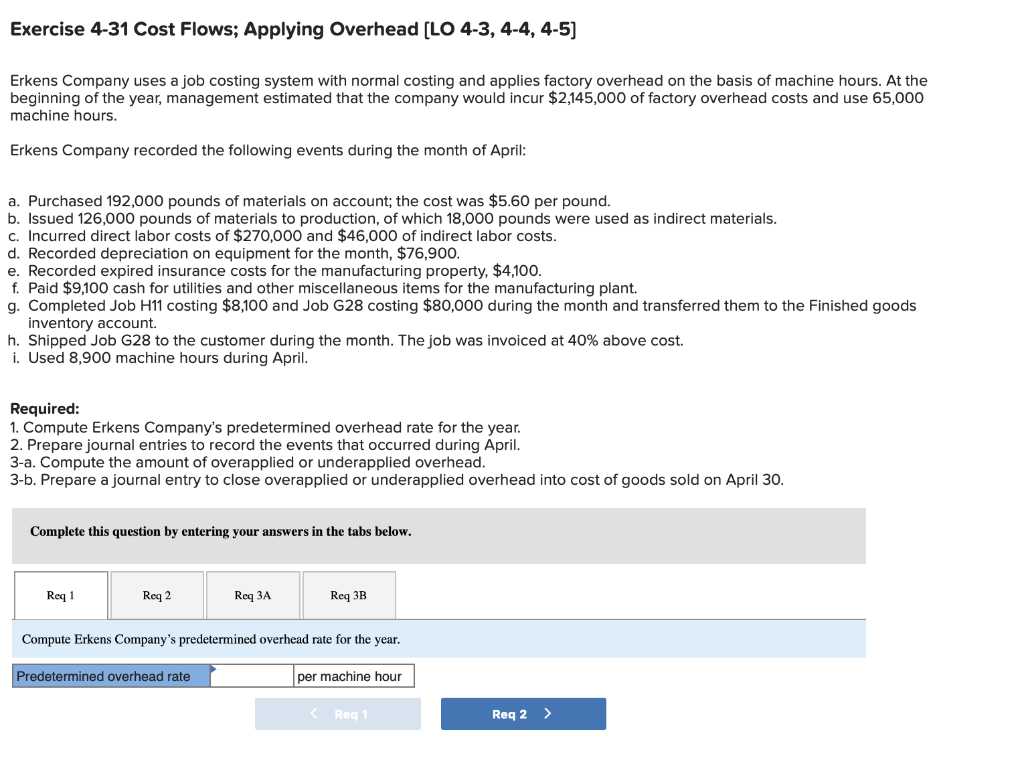

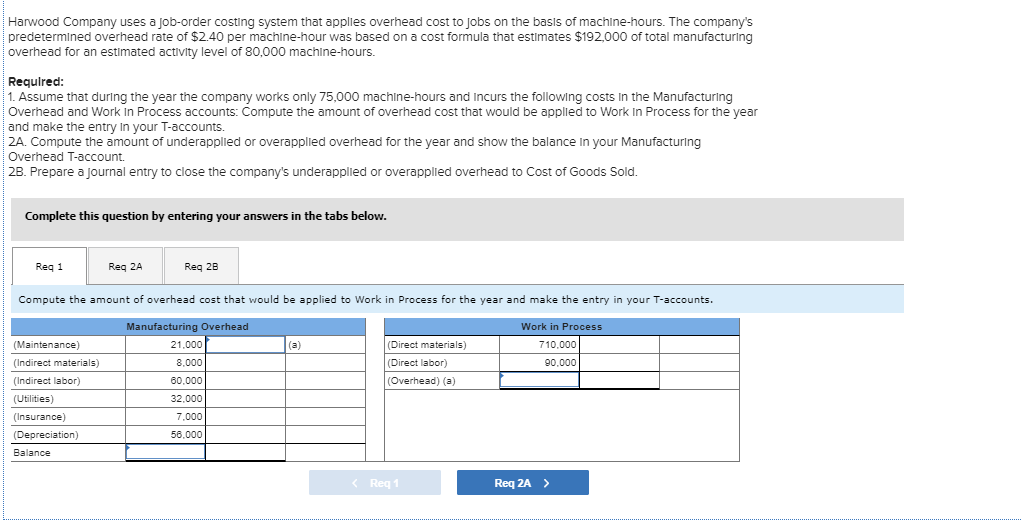

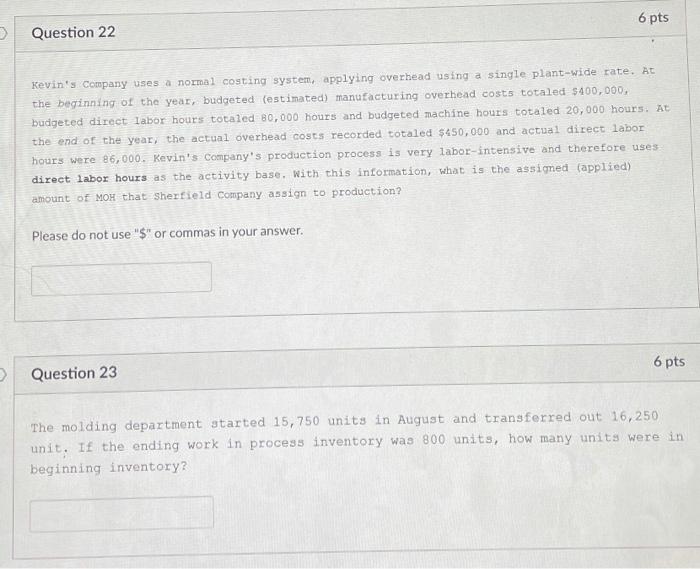

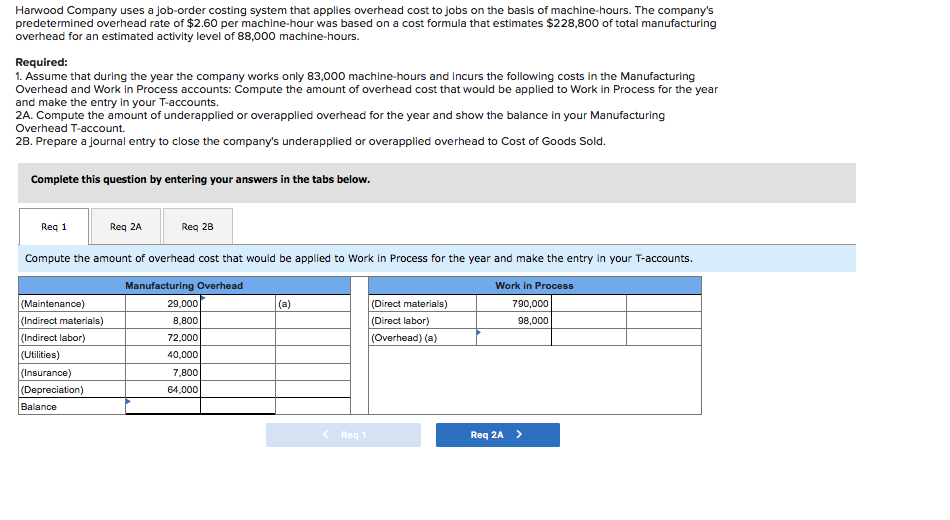

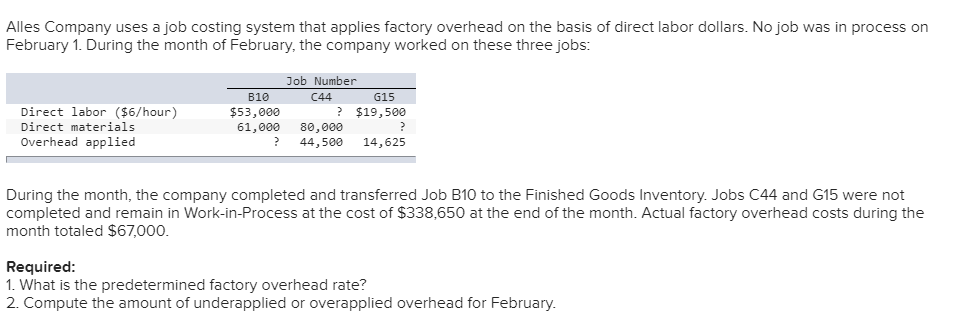

A normal costing system applies overhead. It uses normal costing system that applies factory overhead on the basis of direct labor-hours. Normal costing is used to derive the cost of a product. For the current year the companys predetermined overhead rate was based on a cost formula that estimated 450000 of total manufacturing overhead for an estimated activity level of 75000 machine-hours.

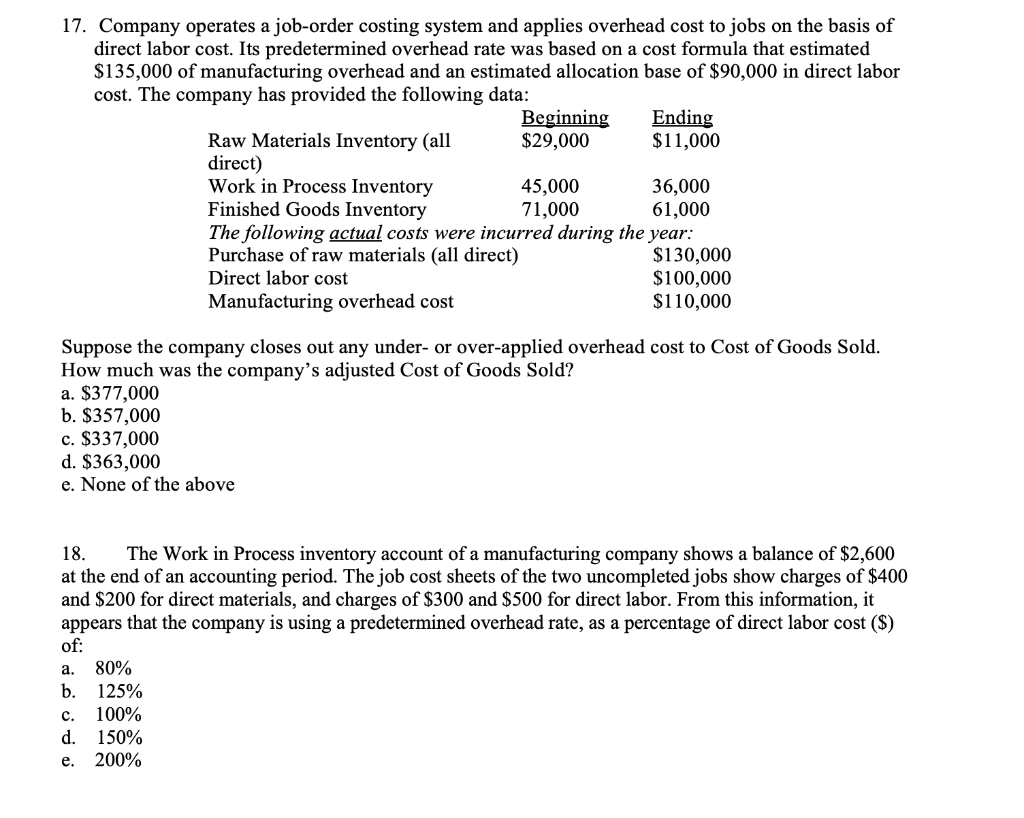

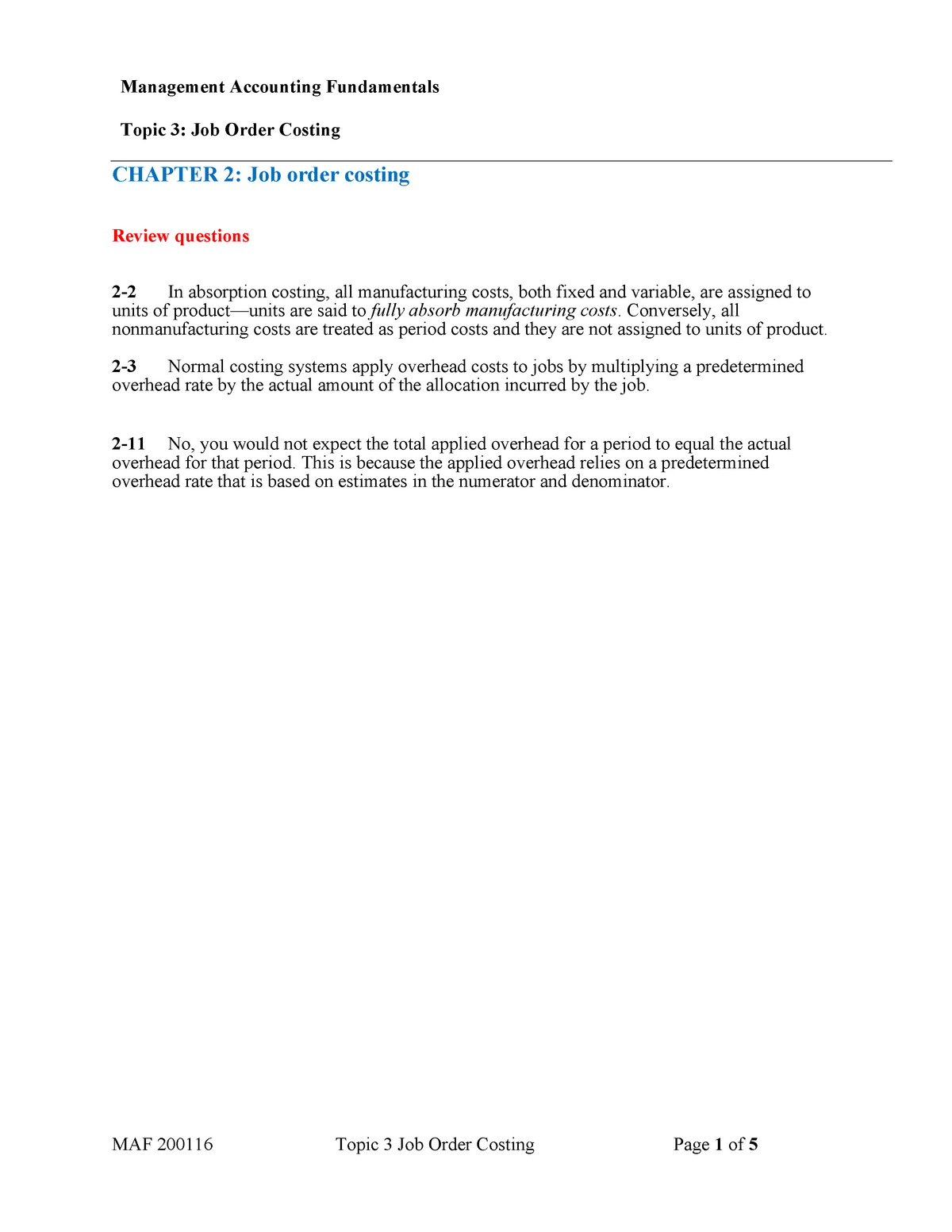

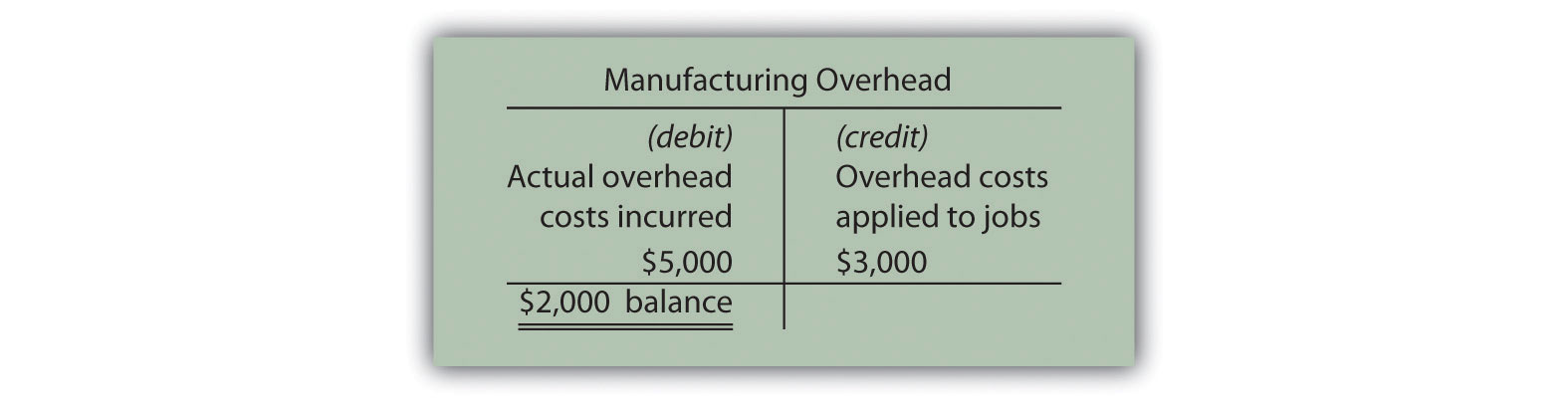

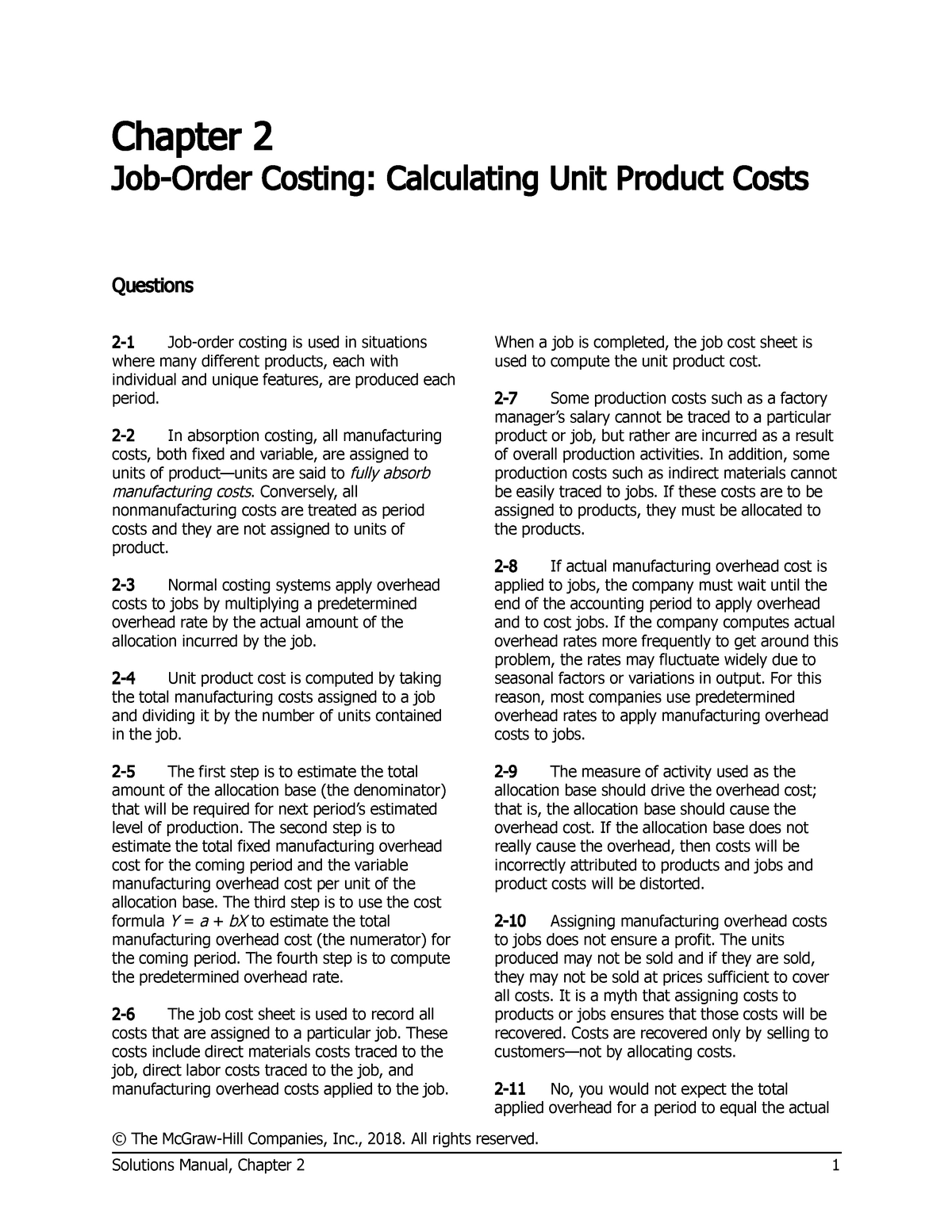

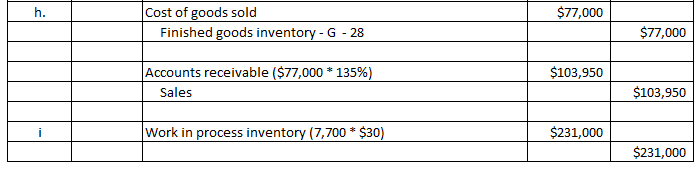

Thus 483000 345000 actual DL cost 14 of overhead was applied of which 24000 483000 459000 actual OH was overapplied. The following transactions took place during the year. At the beginning of the year management estimated that the company would incur 1980000 of factory overhead costs and use 66000 machine-hours.

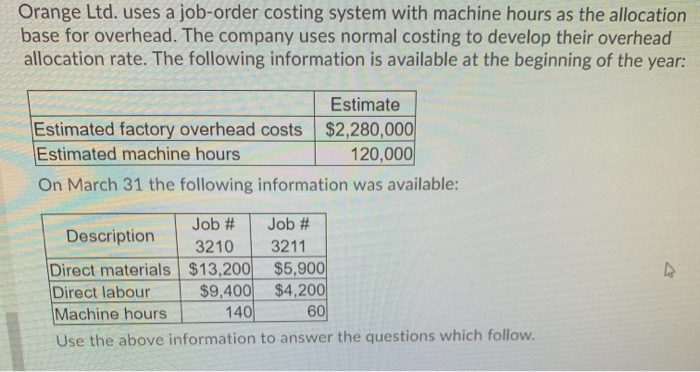

Normal Costing System Definition. At the beginning of the year the following estimates were made for the purpose of computing the predetermined overhead rate. A 60 markup is added to the cost of completed production when finished goods are sold.

At the beginning of the year management estimated that the company would incur 1952000 of factory overhead costs and use 61000 machine hours. Budgeted overhead was less than applied. What is Normal Costing.

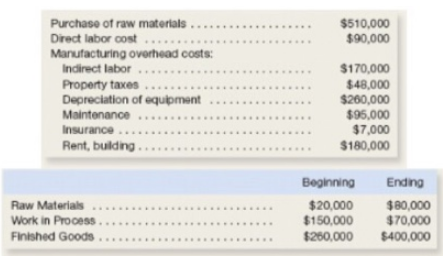

Sanger Corporation debited Cost of Goods Sold and credited Manufacturing Overhead at year-end. On the basis of this information one can conclude that. The company applies overhead cost to jobs on the basis of machine-hours worked.

60000 375 225 x 225 22500. Best Chair expects to produce 40000 HC and 100000 FC next year. Budgeted overhead exceeded actual overhead.

18 was the only job that. Sanger Corporation uses a normal costing system.

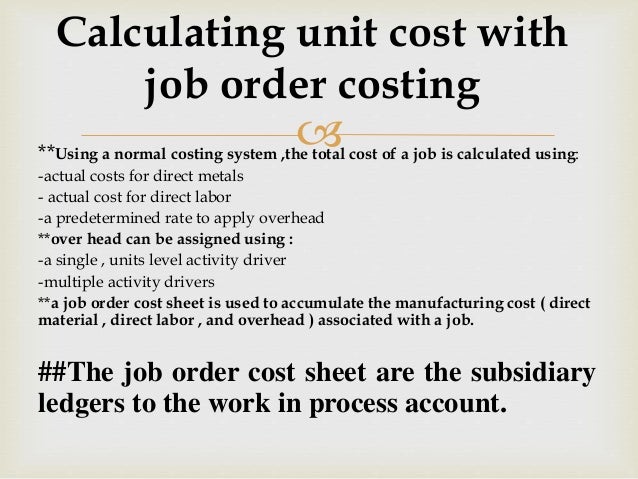

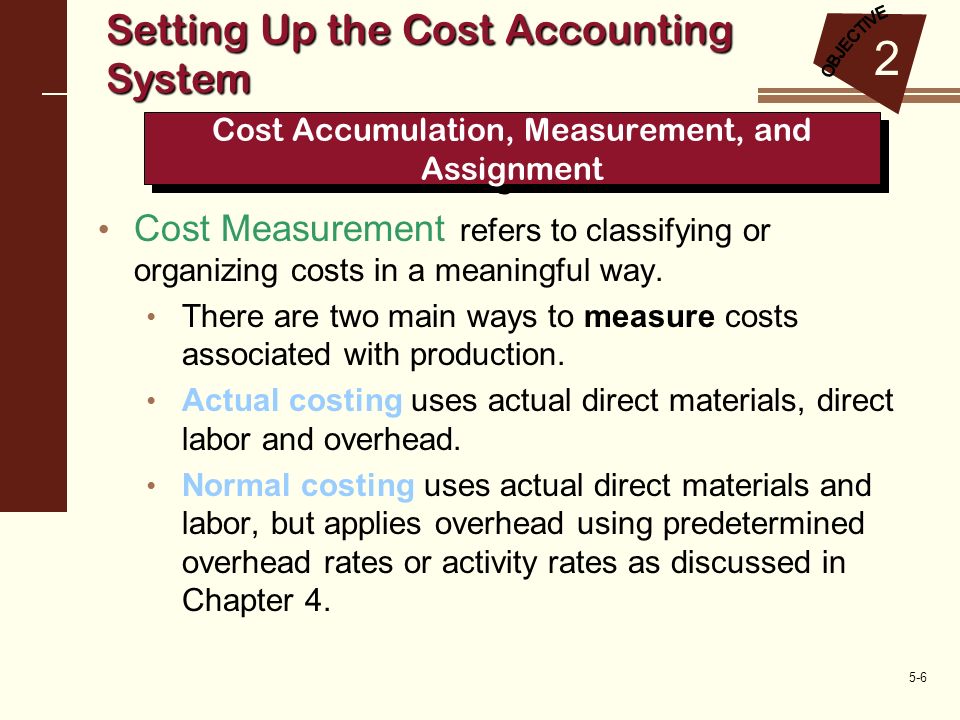

Normal costing is used to derive the cost of a product.

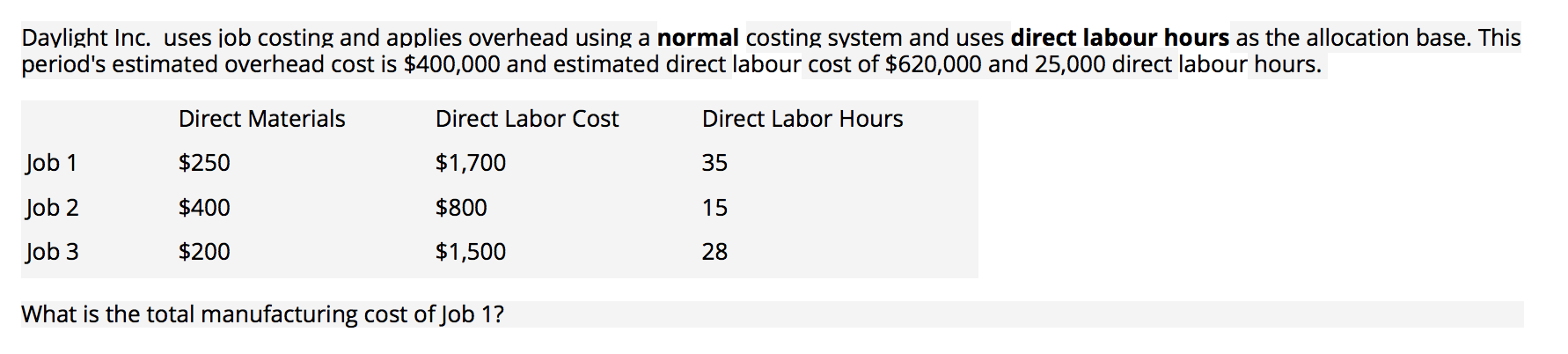

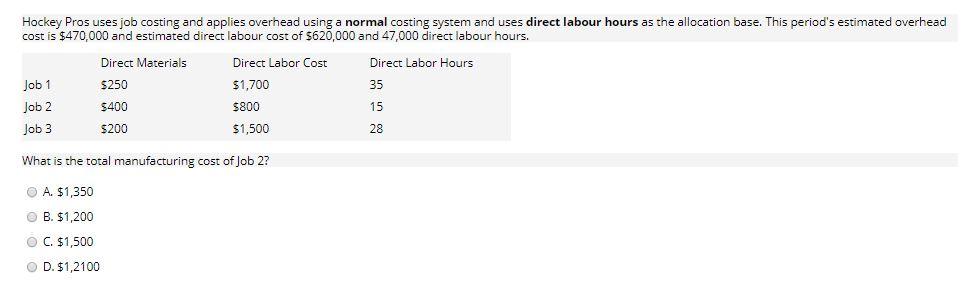

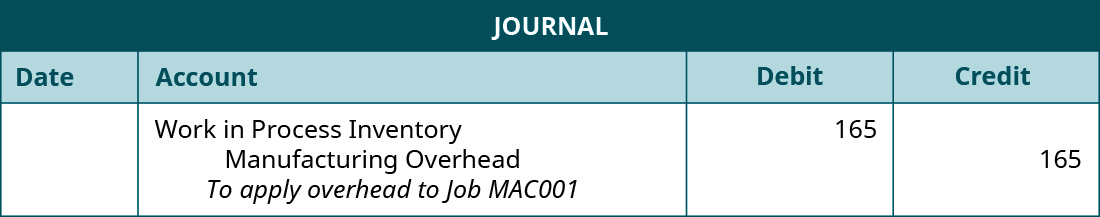

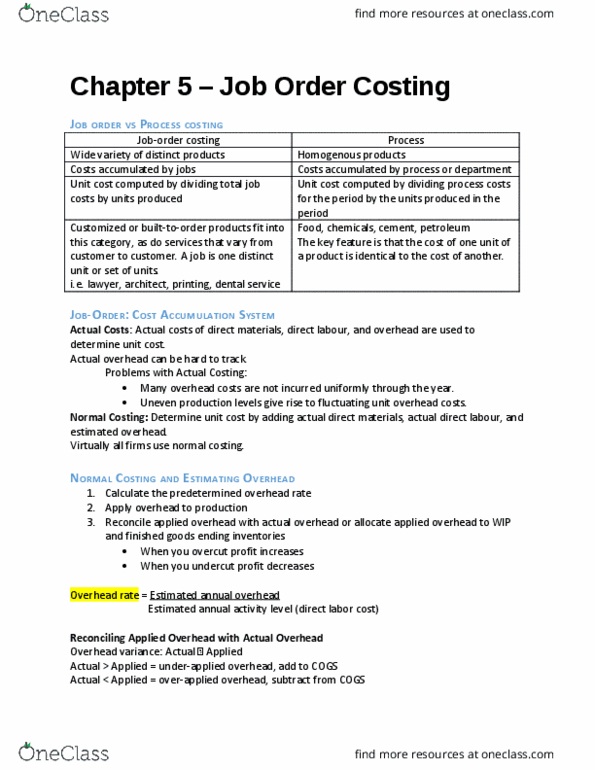

A normal costing system applies overhead by job by multiplying a ____ _____ rate by the ___ _____ of the allocation base incurred by the job-predetermined overhead-actual amount. The difference between the two systems is that the normal costing system uses standard overhead absorption rates based on the overhead budget instead of actual overhead rates. This approach applies actual direct costs to a product as well as a standard overhead rate. Factory overhead for the past years were listed below along with the direct labor hours spent. On the basis of this information one can conclude that. At the beginning of the year management estimated that the company would incur 1980000 of factory overhead costs and use 66000 machine-hours. The company had used a job order costing system and applies overhead on the basis of direct labour hours. In other words the overhead rate under normal costing is based on the expected overhead costs for the entire accounting year and the expected production volume for the entire year. Is a small New England company that manufactures custom clocks.

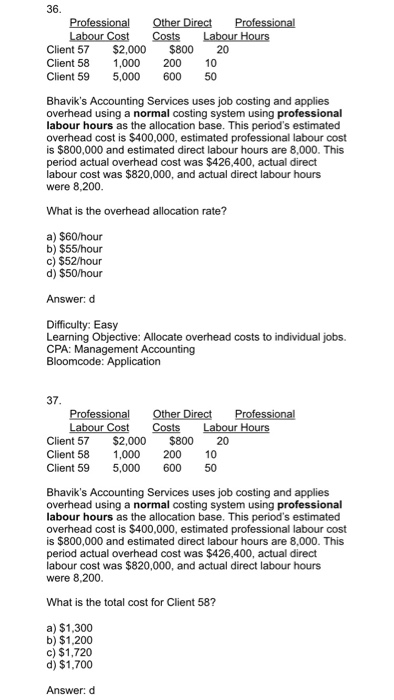

At the beginning of the year the company estimated that total overhead costs for the year would be 180000 and it budgeted total labour-hours of 15000. The following transactions took place during the year. The Jordan Company uses a job order costing system and applies overhead cost to jobs on the basis of direct labor hours. The ending balance in the Finished Goods inventory account was 13000. Answer B is correct. Normal Costing system is a costing system in which overhead costs are applied to jobs by multiplying a predetermined overhead rate by the actual amount of the allocation base incurred by the job. What is the total amount of overhead costs assigned to the deluxe model.

Post a Comment for "A Normal Costing System Applies Overhead"